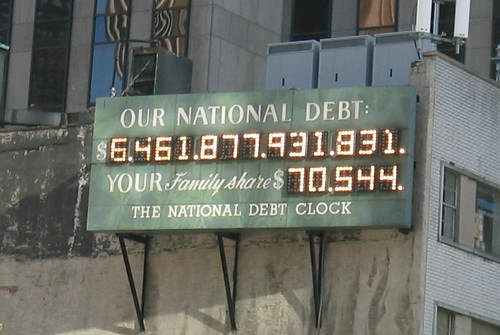

The purchase of European government bonds by China is a good deal, according to a statement released Friday by the Chinese central bank. "On the basis of diversification and fragmentation of the [risk], the investment of foreign exchange reserves in sovereign debt in the euro zone is not only beneficial to international financial stability and that of Europe, but also offers a reasonable return on investment, "the statement said that reports of remarks by Vice-Governor of the bank, Yi Gang.

The purchase of European government bonds by China is a good deal, according to a statement released Friday by the Chinese central bank. "On the basis of diversification and fragmentation of the [risk], the investment of foreign exchange reserves in sovereign debt in the euro zone is not only beneficial to international financial stability and that of Europe, but also offers a reasonable return on investment, "the statement said that reports of remarks by Vice-Governor of the bank, Yi Gang.That is why these investments are expected to "ensure or increase the value of China's foreign exchange reserves," according to Mr. Yi who was speaking during a visit to Spain this week of Chinese Vice-Premier Li Keqiang . The release of the central bank said that China "firmly supports the measures taken by the EU and the IMF" and "the stability of the euro".

The Spanish public debt remains below the European average, but rose 16.3% in one year. China has not officially revealed the amount of Spanish bonds that it intends to purchase, but according to the Spanish daily El Pais on Thursday in Beijing could gain six billion euros, as that what the Chinese government has already purchased debt Greek and Portuguese.

Deputy Prime Minister had indicated in a previous edition of El Pais that his country was "trust the Spanish financial market, which resulted in the purchase of public debt, which we'll continue to do." The interest in China for European government bonds is part of an underlying trend for Beijing, with world largest provider of foreign exchange reserves amounting to nearly 2,600 billion according to estimates by the CIA , which was launched several months in a broad diversification of its reserves, long confined to the dollar.

- Euro falls to lowest in nearly 4 months on debt worries (07/01/2011)

- Euro falls to lowest in nearly 4 mths on debt worries (07/01/2011)

- Black-eyed peas and Champagne for New Year's day (05/01/2011)

- Estonia joins the euro (31/12/2010)

- EUR/USD extends sell-off slightly during muted Asian trade (07/01/2011)

No comments:

Post a Comment